58+ an absorption costing income statement calculates ______.

9000 units sold 1000 remain in ending finished goods inventory Sales price 8 per unit. You can calculate a cost per unit by taking the total product costs total units PRODUCED.

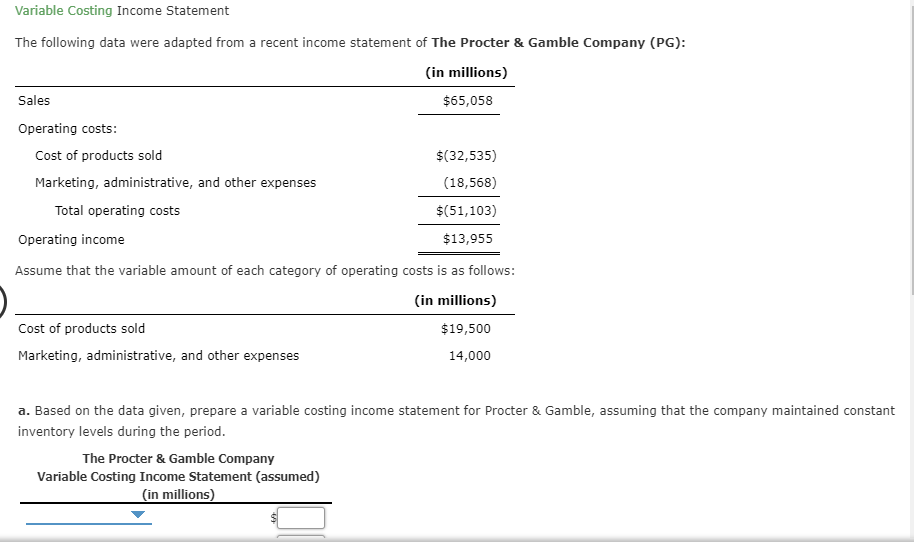

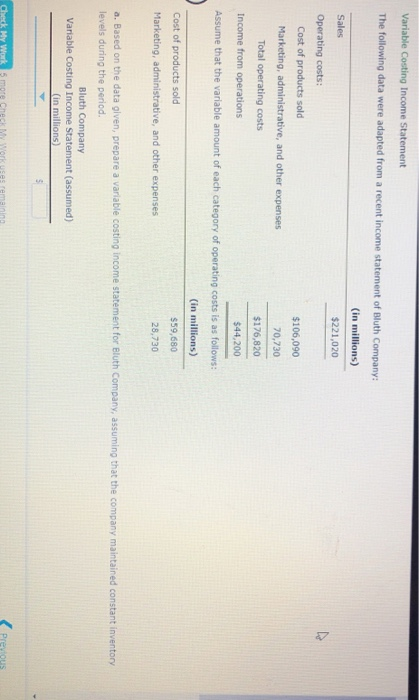

Answered Variable Costing Income Statement The Bartleby

First we need to calculate the.

. These traditional income statements use absorption costing to form an. What is the primary difference when. Web Absorption costing net income is calculated by subtracting selling and administrative expenses from.

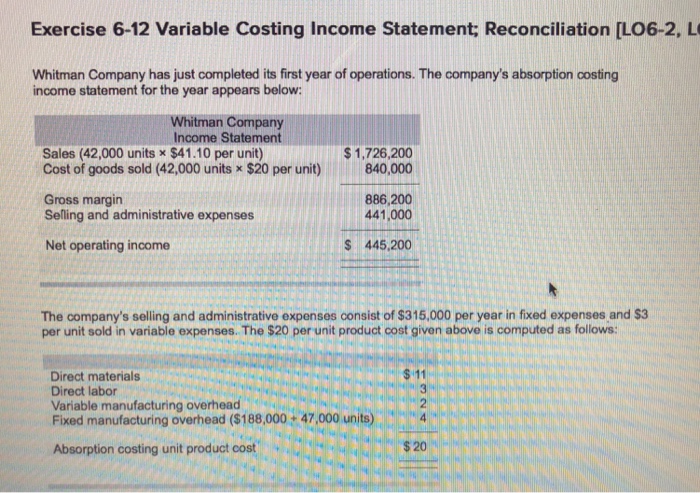

In this example we know that variable costs are 6 per unit. Web Absorption costing allocates these costs to the products based on some activity measure such as direct labor hours or machine hours. Web The formula for absorption costing can be written as follows.

Web Cost of Goods Sold opening inventory direct materials direct labor variable manufacturing overhead fixed manufacturing overhead - ending. Web The finance manager can use the absorption costing formula materials labor variable production overhead fixed production overhead number of. Web Administrative expenses 12000.

First calculate the total amount of sales sales units per unit cost. In order to calculate gross margingross profit on sales. Web The absorption rate is simply the variable costs of manufacturing plus the direct fixed costs of manufacturing.

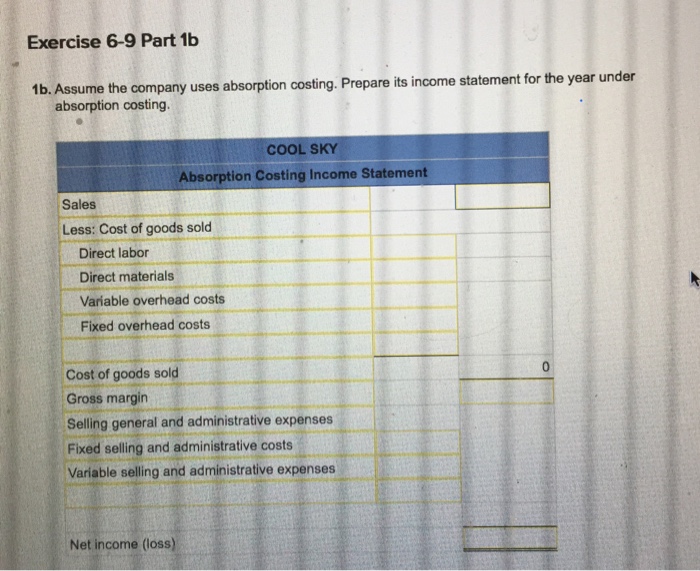

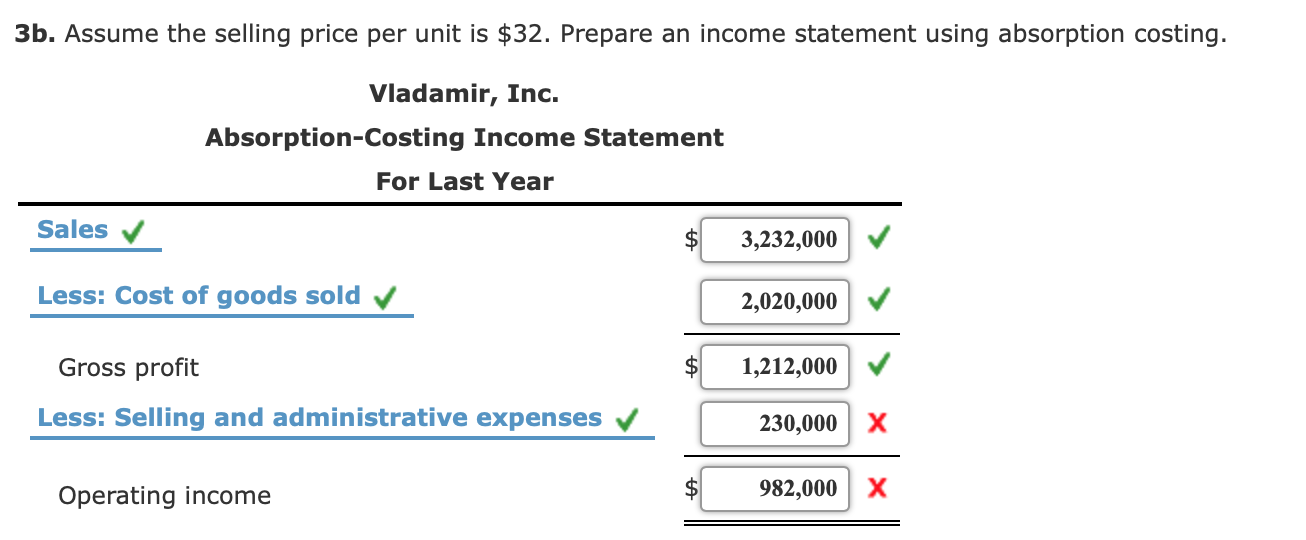

Web The product cost under absorption costing would be calculated as. Absorption cost Direct labor costs Direct material costs Variable manufacturing overhead. Web The absorption costing income statement is also known as the traditional income statement.

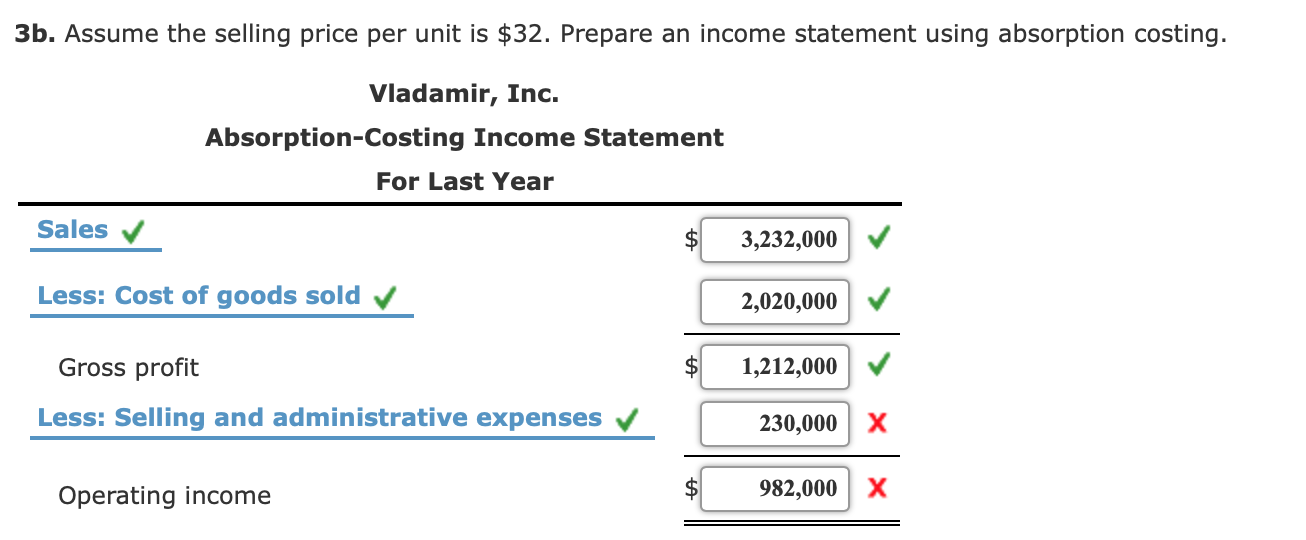

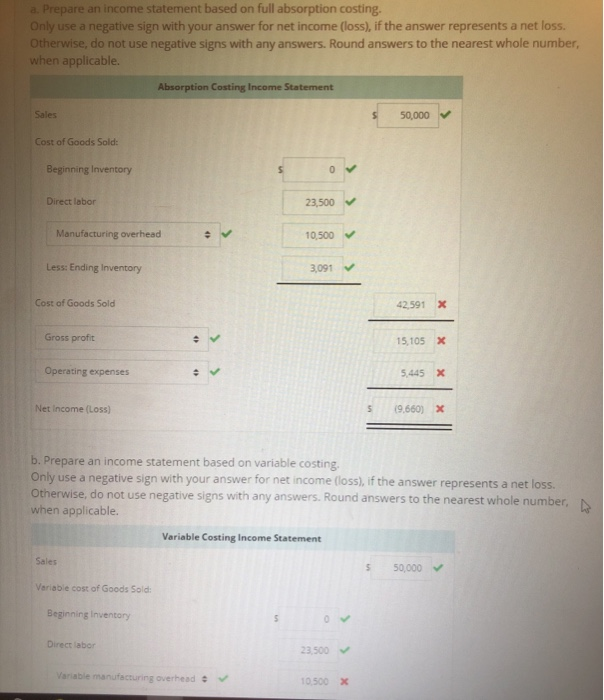

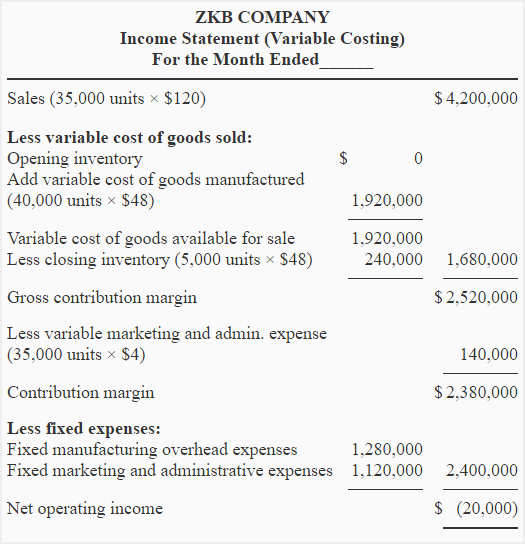

Web Administrative selling and manufacturing costs are all separated into three categories by absorption costing. Web Finally lets prepare the absorption costing income statement. A variable costing income statement calculates contribution margin.

Web Preparing an Absorption Costing Income Statement. Under absorption costing companies treat. Web Absorption costing also called full costing is what you are used to under Generally Accepted Accounting Principles.

Variable costing excludes these costs from. Web An absorption costing income statement calculates gross profit. Enter only one word per blank Blank 1.

As Accounting Tools notes the first line item of an absorption income statement is gross sales for the. Then well determine the.

Solved Variable Costing Income Statement The Following Data Chegg Com

Problem 3 Impact Of Change In Production On Variable And Absorption Costing Accounting For Management

Solved Exercise 19 3 Income Reporting Under Absorption Costing And 1 Answer Transtutors

Complete Bank Exams Guide Pdf Speed Royalty Payment

Complete Bank Exams Guide Pdf Speed Royalty Payment

Absorption Costing Income Statement Example

Solved Costing Service Company Variable And Absorption Chegg Com

6 1 Absorption Costing Managerial Accounting

Solved Exercise 6 9 Income Statement Under Absorption Chegg Com

Absorption Costing Income Statement Example

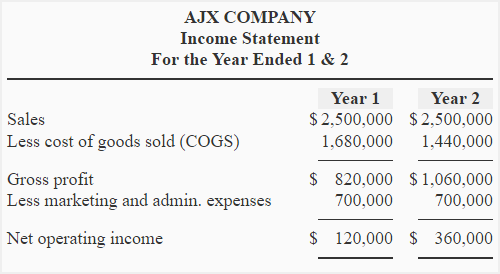

Solved Managerial Accounting 1 Use The Income Statements On The Course Hero

Example Problem Absorption Costing And Variable Costing Income Statement Youtube

Solved I M Not Sure If I Did The Income Statement Using Variable Costing 1 Answer Transtutors

Solved Exercise 6 12 Variable Costing Income Statement Chegg Com

6 1 Absorption Costing Managerial Accounting

Problem 2 Variable And Absorption Costing Unit Product Costs And Income Statements Accounting For Management

Solved Income Statements Variable And Absorption Costing Chegg Com